Checking out the Question: Does Afterpay Affect Credit Score in the Long-term?

Checking out the Question: Does Afterpay Affect Credit Score in the Long-term?

Blog Article

Evaluating Whether Afterpay Use Can Impact Your Credit Rating

As the appeal of Afterpay proceeds to rise, many people are left wondering concerning the possible impact this solution might carry their credit rating. The connection between Afterpay usage and debt scores is a topic of rate of interest for those intending to maintain or boost their monetary health. By exploring the subtleties of how Afterpay purchases are watched in the eyes of debt bureaus, we can start to unwind the intricacies of this contemporary payment method's impact on one's creditworthiness. Let's explore the details of this relationship and uncover the key variables at play.

Understanding Afterpay's Influence on Credit report

While Afterpay does not execute credit scores checks when customers at first sign up, late or missed out on settlements can still impact credit report scores. When a consumer misses a settlement, Afterpay might report this to credit history bureaus, leading to an adverse mark on the individual's credit scores report. Keeping an eye on settlement due days, preserving a great settlement history, and making certain all installations are paid on time are essential actions in protecting one's credit report rating when using Afterpay.

Factors That Influence Credit Report Adjustments

Comprehending Afterpay's effect on debt ratings discloses a direct web link to the numerous variables that can significantly affect adjustments in an individual's credit rating in time. One essential factor is payment background, representing concerning 35% of a credit history. Making on-time settlements continually, consisting of those for Afterpay acquisitions, can positively influence the credit scores rating. Credit report application, that makes up about 30% of ball game, is one more crucial factor. Using Afterpay sensibly without maxing out the offered credit score can aid maintain a healthy and balanced credit history usage ratio. The length of credit report, contributing around 15% to the rating, is also important. Making use of Afterpay over a prolonged period can favorably influence this facet. Furthermore, brand-new credit history questions and the mix of charge account can influence credit rating. does afterpay affect credit score. Although Afterpay may not directly influence these aspects, comprehending their significance can assist people make notified choices to preserve or enhance their credit history while making use of solutions like Afterpay.

Surveillance Credit History Rating Adjustments With Afterpay

Checking credit rating changes with Afterpay entails tracking the impact of settlement behaviors and credit scores utilization on total credit scores health and wellness. Making use of Afterpay for small, manageable purchases and maintaining credit history card balances reduced family member to credit scores limitations demonstrates liable debt actions and can positively affect credit score scores. By remaining proactive and vigilant in monitoring payment routines and debt application, people can properly handle their credit history score while making use of Afterpay as a repayment alternative.

Tips to Handle Afterpay Responsibly

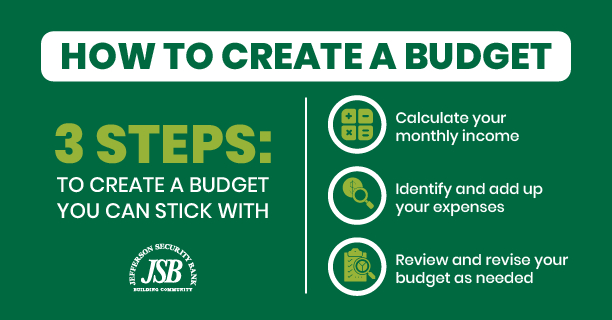

To browse Afterpay sensibly and maintain a healthy credit report, individuals can implement efficient approaches to handle their economic responsibilities sensibly. Firstly, it is important to develop a budget plan laying out earnings and expenses to guarantee price prior to dedicating to Afterpay acquisitions. This practice aids stop overspending and collecting debt over one's head's means. Second of all, utilizing Afterpay uniquely for essential items instead of indulgent purchases can help in maintaining economic security. Focusing on payments for requirements can avoid unneeded financial stress and promote liable costs practices. In addition, monitoring Afterpay settlement timetables and guaranteeing prompt repayments can aid stay clear of late charges and unfavorable effect on credit score ratings. Consistently keeping an eye on Afterpay deals and overall financial Check Out Your URL health and wellness with budgeting apps or spread sheets can offer beneficial understandings into costs patterns and help in making educated economic choices. By adhering to these ideas, individuals can take advantage of Afterpay sensibly while protecting their credit report and economic wellness.

Conclusion: Afterpay's Duty in Credit report Health

In evaluating Afterpay's influence on credit scores wellness, it comes to be obvious that sensible financial management stays extremely important for people utilizing this service. While Afterpay itself does not directly impact credit history, overlooking repayments can bring about late fees and debt build-up, which could indirectly influence creditworthiness - does afterpay affect credit score. It is critical for Afterpay users to budget plan efficiently and make certain prompt payments to maintain a favorable credit scores standing

Moreover, comprehending just how Afterpay incorporates with individual find finance habits is essential. By using Afterpay responsibly, individuals can delight in the ease of staggered settlements without threatening their debt wellness. Monitoring spending, evaluating price, and staying within budget plan are fundamental methods to avoid financial strain and potential credit history implications.

Conclusion

Recognizing Afterpay's impact on debt ratings exposes a direct link to the different factors that can dramatically affect changes in an individual's credit history rating over time. Furthermore, brand-new credit inquiries and the mix of credit report accounts can influence debt scores.Checking credit history rating changes with Afterpay involves tracking the influence of settlement behaviors and credit scores usage on total credit history health and wellness - does afterpay affect credit score. Making use of Afterpay for tiny, convenient purchases and keeping credit report card equilibriums look these up reduced family member to credit limitations demonstrates responsible credit actions and can positively influence credit history scores. By remaining proactive and cautious in checking repayment practices and credit scores utilization, individuals can effectively manage their credit scores score while making use of Afterpay as a repayment option

Report this page